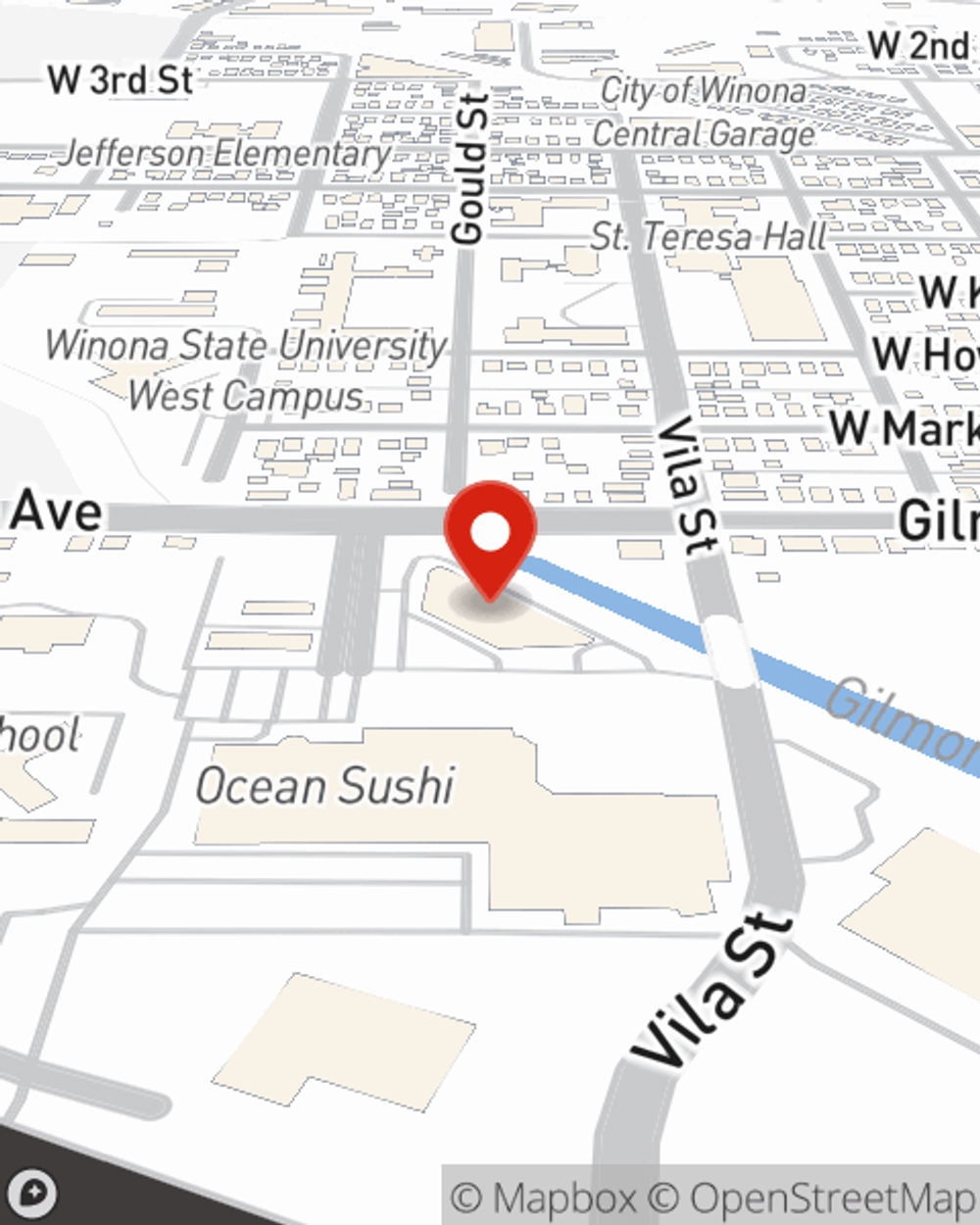

Insurance in and around Winona

A variety of coverage options to help meet your needs

Great insurance and a great value

Would you like to create a personalized quote?

- Winona

- Wabasha

- Goodhue County

- Dakota County

- Le Seur County

- Waseca County

- Steele County

- Dodge County

- Olmsted County

- Houston County

- Fillmore County

- Mower County

- Freeborn County

- Grant County

- Crawford County

- Vernon County

- La Crosse County

- Trempealeau

Tried And True Insurance Customizable To Fit You

Life is often unpredictable. We understand your need to help protect what matters most. With State Farm insurance, you can design a Personalized Price Plan® that's right for you, your loved ones, and the life you've built. Contact agent Anthony Vote to see how you can get started with safe driving rewards, and bundling options and discounts.

A variety of coverage options to help meet your needs

Great insurance and a great value

Got An Objective In Mind? Let Us Help You Get There

Want to know why State Farm is the largest insurer of automobiles and homes in the U.S.? Great insurance coverage options, competitive prices, easy claims and excellent service might have a lot to do with it. Or maybe you're looking to help secure your family's financial future. Let us help you ease that burden. The unmatched strength of State Farm Life Insurance, a wide range of products and Personalized Price Plans; it's a great value and smart choice.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Anthony Vote

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.