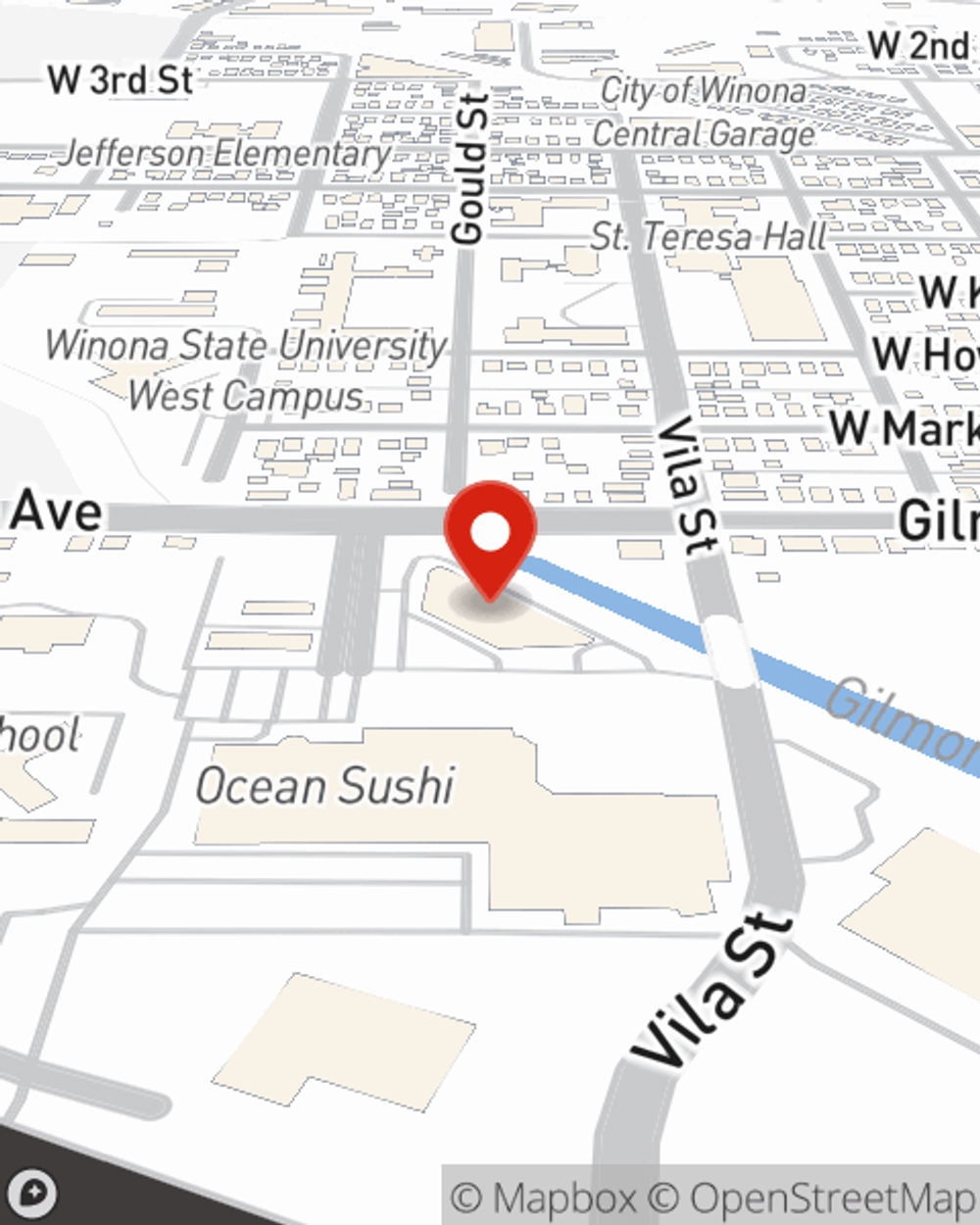

Business Insurance in and around Winona

One of the top small business insurance companies in Winona, and beyond.

This small business insurance is not risky

- Winona

- Wabasha

- Goodhue County

- Dakota County

- Le Seur County

- Waseca County

- Steele County

- Dodge County

- Olmsted County

- Houston County

- Fillmore County

- Mower County

- Freeborn County

- Grant County

- Crawford County

- Vernon County

- La Crosse County

- Trempealeau

Business Insurance At A Great Value!

Operating your small business takes dedication, effort, and outstanding insurance. That's why State Farm offers coverage options like business continuity plans, extra liability coverage, a surety or fidelity bond, and more!

One of the top small business insurance companies in Winona, and beyond.

This small business insurance is not risky

Get Down To Business With State Farm

Your company is special. It's where you make your living and also how you grow your life—for yourself but also for your loved ones, and those who work for you. It’s more than just an office or earning a paycheck. Your business is an extension of yourself. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is to get outstanding small business insurance from State Farm. Small business insurance covers numerous occupations like an HVAC contractor. State Farm agent Anthony Vote is ready to help review coverages that fit your business needs. Whether you are a taxidermist, an optician or a podiatrist, or your business is a pottery shop, an advertising agency or an acting school. Whatever your do, your State Farm agent can help because our agents are business owners too! Anthony Vote understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Ready to explore the business insurance options that may be right for you? Call or email agent Anthony Vote's office to get started!

Simple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Anthony Vote

State Farm® Insurance AgentSimple Insights®

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.